Visual Capitalist, Published on By

Against all odds, sustainable investing in the U.S. smashed records in 2020.

Estimated net flows reached $20.9 billion in the first six months alone—that’s nearly equal to the amount of new money invested in all of 2019.

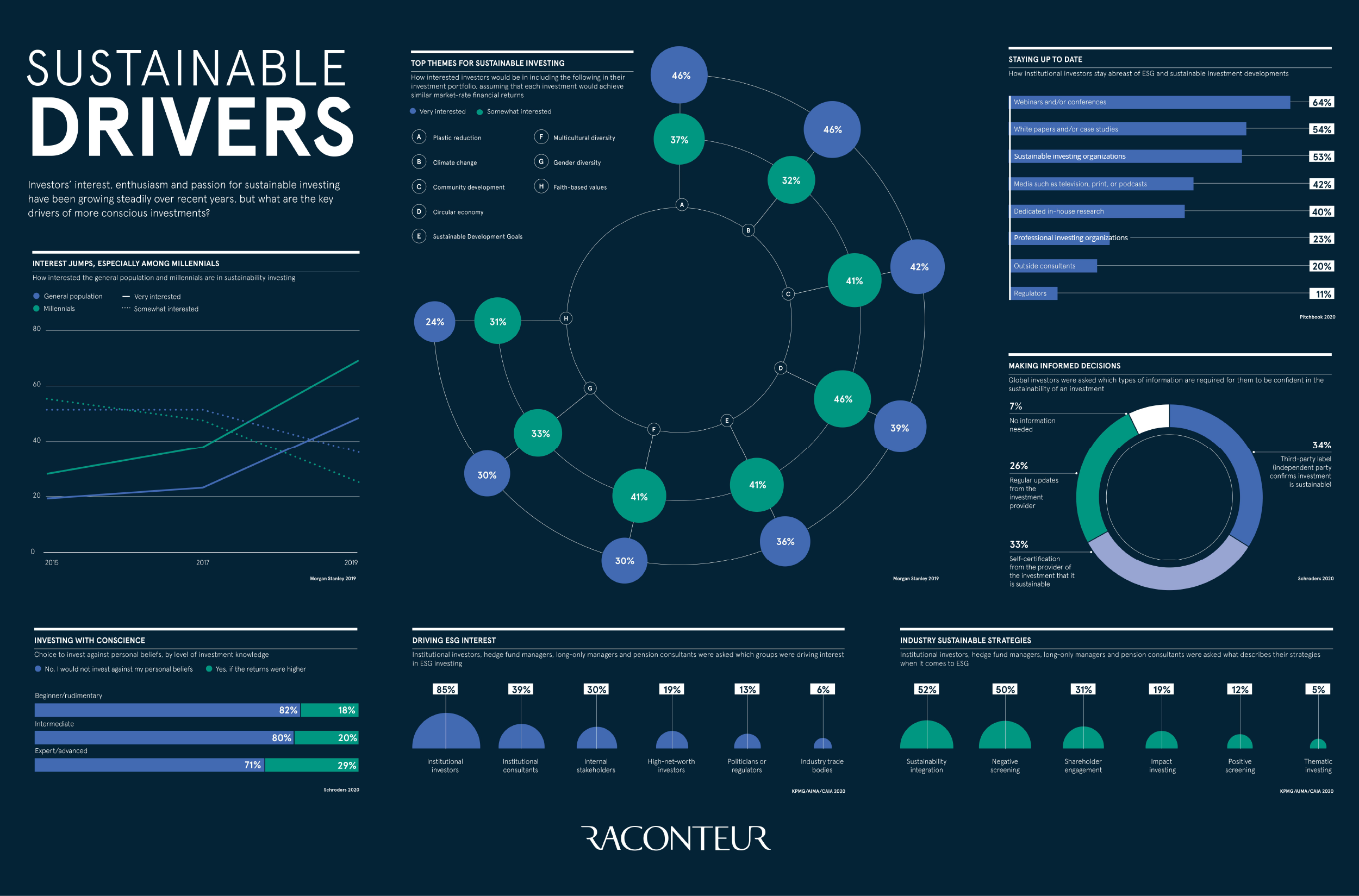

What is driving the shift to sustainable investing? This visual dashboard from Raconteurexplains five key drivers, from generational shifts to investors’ preferred strategies.

DRIVER #1:

Millennial Investors and Personal Beliefs

Interest in sustainable investing is booming across the general population. However, there’s a clear generational trend, as well.

While the portion of each group that is “very interested” in sustainable investing has shot up since 2015, this share is significantly higher for millennials.

| Year | General Population | Millennials |

|---|---|---|

| 2015 | 19% | 28% |

| 2017 | 23% | 38% |

| 2019 | 49% | 70% |

Another correlated trend emerges with this.

These days, investors are more likely to follow their conscience. Acccording to a recent reportby Schroders, the majority of investors will not budge on investing against their beliefs, even if returns were theoretically higher.

| Level of Investment Knowledge | |||

|---|---|---|---|

| Would you invest against your personal beliefs? | Beginner | Intermediate | Expert |

| Yes, if returns are higher | 18% | 20% | 29% |

| No, I would not invest against my beliefs. | 82% | 80% | 71% |

DRIVER #2:

Top Themes of Interest

Powered by these personal beliefs, which categories are attracting investors? It turns out many investors are very interested in including environment-related themes into their portfolios:

- Plastic reduction: 46%

- Climate change: 46%

- Community development: 42%

- Circular economy: 39%

- Sustainable Development Goals: 36%

- Multicultural diversity: 30%

- Gender diversity: 30%

- Faith-based values: 24%

However, these aren’t the only considerations. Other themes that fit into broader ESG categories such as gender diversity or faith-based values make an appearance, too.

DRIVER #3:

Which Investor Groups are Driving Interest?

Now, we turn our attention to the specific groups that are responsible for the growing momentum towards sustainable investing. This may be surprising to some, but it is institutional investors that are leading the pack by far:

| Group | Share of Group |

|---|---|

| Institutional investors | 85% |

| Institutional consultants | 39% |

| Internal stakeholders | 30% |

| High net worth (HNW) investors | 19% |

| Politicians or regulators | 13% |

| Industry trade bodies | 6% |

This also disproves a common myth that millennials are the only ones interested in the sector. Institutional investors equally want to see a double bottom line: an ROI on their money, while also making the world a more sustainable place.

DRIVER #4:

Sources of Information

So where are institutional investors sourcing their information around sustainable investing? Sharing their ideas in like-minded communities, such as webinars and conferences emerged as the preference for nearly two-thirds of those surveyed in this group.

But how do investors know that their investment is truly sustainable? For this, 34% of global investors feel that third-party labels from independent organizations help lend credibility, and confirm that the chosen investment in question is indeed carried out in a responsible manner.

As more and more institutional investors are digital natives, a significant share of them are also beginning to use social media to influence their decision-making process—and some even rely on it as their key source of research.

DRIVER #5:

Sustainable Investing Strategies

We’ve left the best for last—armed with this knowledge and confidence, which sustainable investing strategies are the most attractive? Here’s how organizations are approaching ESG:

- Sustainability integration: 52%

- Negative screening: 50%

- Shareholder engagement: 31%

- Impact investing: 19%

- Positive screening: 12%

- Thematic investing: 5%

While negative screening—avoiding investments in “sin” stocks such as tobacco or fossil fuels—is still a popular strategy, actively integrating sustainability into one’s portfolio is emerging more front and center.

The Overall Trend of Sustainable Investing

The data makes clear that institutional investors are the main driving forces behind sustainable investment for the time being. But as millennials accumulate wealth, their values may naturally lead them towards more sustainable investment.

Another important point to note is that sustainable investing has been resilient to change. In fact, despite the COVID-induced stock selloff in early 2020, ESG leaders exceeded expectations.

While these drivers evolve over time, it’s clear that sustainable investing is more than having its moment in the spotlight—it’s here to stay.