Seeking Alpha, Jul. 04, 2021 1:15 PM ETEFIV, ESG…By: Liz Kiesche

- A recent research report indicates that assessing investments and acquisitions by environmental, social, and governance criteria isn’t just a question of social consciousness but pays off financially as well.

- 65% of dealmakers in a survey conducted by advisory firm Baker Tilly and Acuris say ESG is important in considering investments and M&A, and 60% say they have walked away from an investment when a potential target doesn’t measure up.

- 52% say their ESG investment strategy has helped overall investment returns.

- Recall that last year BlackRock chief Larry Fink pointed out in his annual letter to CEOs that corporations that ignore sustainability risk will face a higher cost of capital. And earlier this year, Moody’s analysts said ESG issues will take on greater importance this year.

- “The return on investment in companies with a good ESG record is hard to ignore, with investors reporting that ESG strategies are delivering improved returns,” said Julie Haeflinger, executive corporate finance at Baker Tilly Strego, an advisory firm.

- “Our reports shows that reputation and brand management are increasingly front of mind and valuations are being affected by ESG considerations,” she added.

- Problems with ESG issues “not only damage the public perception and bottom line of a business, but they make a business far less attractive to investors or buyers looking at M&A,” said Michael Sonego, who leads Baker Tilly’s Corporate Finance strategic group.

- The key driver for the focus on ESG in investing is to stave off the threat of regulation against a backdrop of increasing global demands for more sustainable investment, the report said.

- A second driver is legal risk, including class actions against companies for alleged ESG abuses by consumers and shareholders.

- “Bidders want some certainty that are not buying a lawsuit waiting to happen, and strong ESG performance gives them comfort that won’t be the case,” Sonego said.

- Law firm Torys LLP also points out the growing importance of ESG factors when it comes to M&A. “Effective diligence, evaluation and management of ESG considerations are critical steps for parties to take to mitigate risk, achieve beneficial outcomes and synergies, and successfully execute transactions,” it said in a January 2021 article.

- In the Baker Tilly report, Western Europe was cited by 98% of respondents as the region doing the most to promote or prioritize ESG goals, followed by North America (82%), Japan (80%), and the U.K. (77%.)

- By industry, technology, media and telecom is seen as the leading sector for ESG by 93% of respondents, followed by the consumer sector and financial services (each on 63%) and pharmaceutical and biotech (60%).

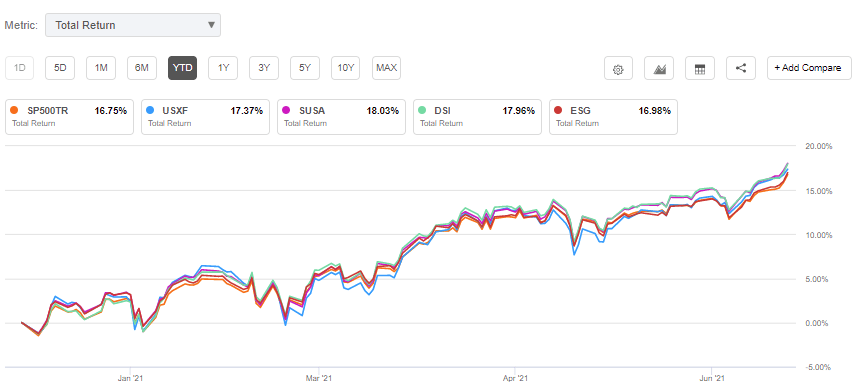

- ESG-focused ETFs to watch: EFIV, USXF, VTRN, SUSA, DSI, ESG, SPYX

- In YTD performance, the total return of such ETFs as DSI, SUSA, USXF and ESG did at least as well as the S&P 500 as seen in chart below.

- AllianceBernstein explains howESG integration can help solve challenges to investing in emerging market corporates.