Medium, End of Week Notes, Jon Hale

Unified agenda lists expected actions to be taken by Departments and Agencies this year and next

The Biden Administration announced its regulatory action agenda today, with ESG issues figuring prominently on the list of issues to be considered by the Securities and Exchange Commission and the Department of Labor’s Employee Benefits Securities Administration.

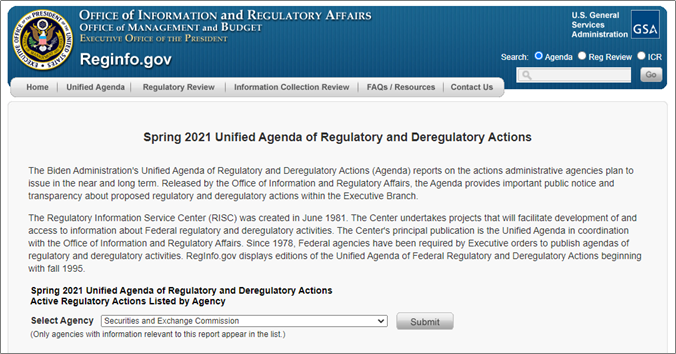

Released by the Office of Information and Regulatory Affairs, the Spring 2021 Unified Agenda of Regulatory and Deregulatory Actions, contains no real surprises, but can be seen as a comprehensive list of actions that administrative agencies plan to take, with time frames included.

DOL/EBSA: Suspend, revise, or rescind 2020 rules related to ESG fund selection and proxy voting in retirement plans

Based on directives included in two Executive Orders, DOL/EBSA will publish a proposed rulemaking by September 2021 that suspends, revises, or rescinds two rules adopted late last year, “Financial Factors in Selecting Plan Investments,” 85 FR 72846 (November 13, 2020), and “Fiduciary Duties Regarding Proxy Voting and Shareholder Rights,” 85 FR 81658 (December 16, 2020).

Both rules have muddied the waters for fiduciaries of ERISA retirement plans who want to include ESG options and to exercise their shareholder rights through engagement and proxy voting.

The SEC agenda is more varied, ranging from corporate issuer disclosures to shareholder rights to registered investment advisor disclosures about ESG-related claims:

SEC: Climate Change Disclosure

Propose rule amendments by October 2021 to enhance registrant disclosures regarding issuers’ climate-related risks and opportunities.

SEC: Corporate Board Diversity Disclosure

Propose rule amendments by Octobr 2021 to enhance registrant disclosures about the diversity of board members and nominees.

SEC: ESG claims and disclosures for investment companies and advisers

Propose requirements by April 2022 for investment companies and investment advisers related to environmental, social and governance (ESG) factors, including ESG claims and related disclosures.

SEC: Amend Rule 14a-8 regarding shareholder proposals

Propose rule amendments by April 2022 regarding shareholder proposals under Rule 14a-8.

The SEC under the previous administration tightened the standards for a shareholder to be eligible to propose a resolution at a company’s annual general meeting, and the voting thresholds for automatic resubmission of shareholder proposals.

SEC: Proxy Voting Advice

Propose rule amendments by April 2022 governing proxy voting advice.

The SEC under the previous administration made sweeping changes to the rule governing proxy advisory firms that make it more difficult for them to give unvarnished advice and forces them to provide company rebuttals to their clients.

SEC: Reporting of Proxy Votes on Executive Compensation

Repropose rule amendments by November 2021 that would require institutional investment managers to report how they voted on any shareholder vote on executive compensation or golden parachutes.

No guarantees that all these agenda items will pass, of course, but at least these issues are offically on the Biden Administration agenda with set time frames for action.

Follow me on Twitter: @Jon_F_Hale