Those close to us will have noticed that the structure of LocalGlobe has evolved from 2002 to today — there are new faces on the team too. More important is what has remained the same: our unwavering focus on being the best possible partner to founders on their journey from Seed to Series A.

There’s been a lot of confusion in the ecosystem about what Seed and Series A means today — both in Europe and in the US. We put aside our preconceived ideas and alongside Atomico and Dealroom decided to look at the data to answer the key questions founders have.

What Founders should look for at Seed?

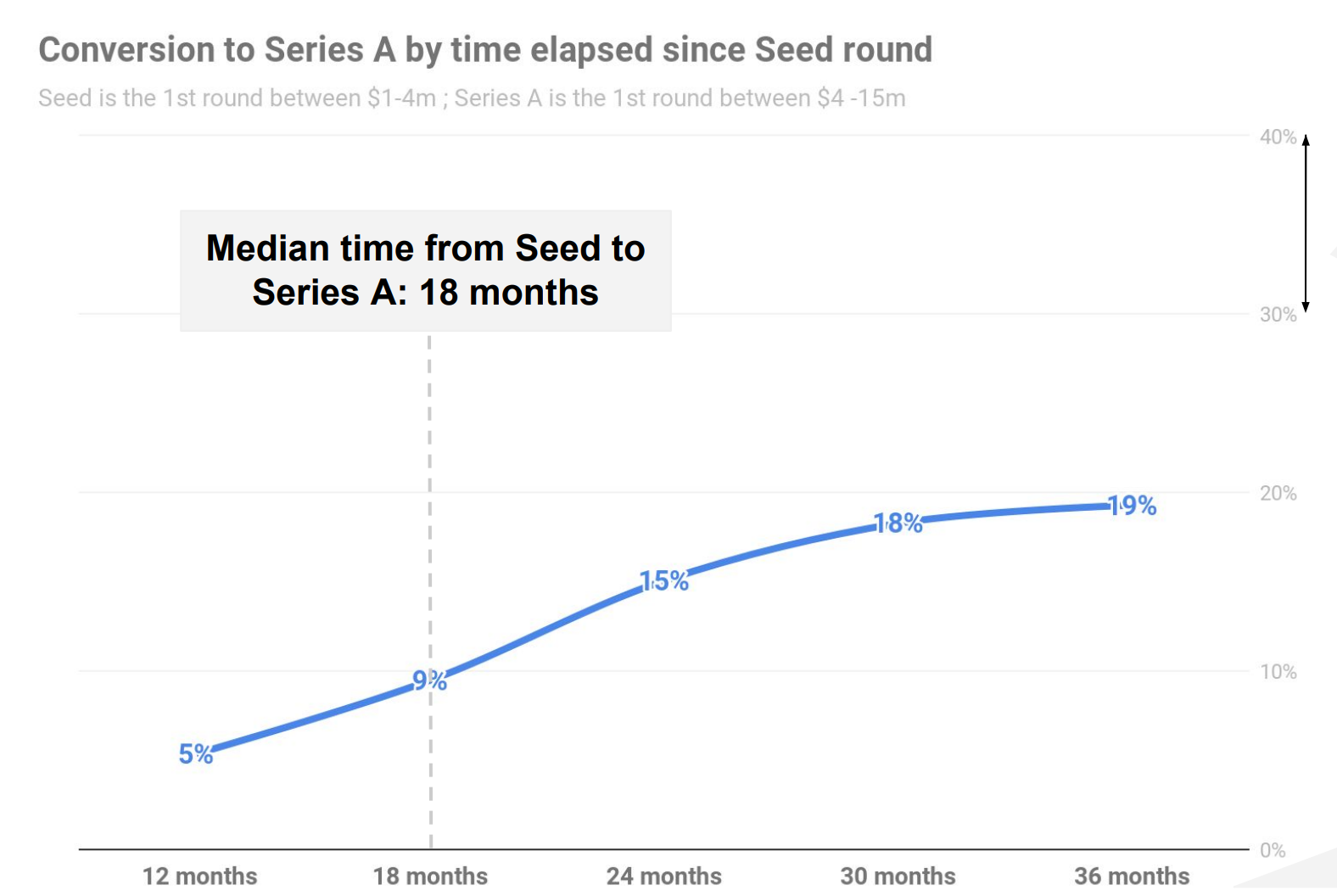

- How long do I need? 18–24 months runway — In 2015 when we started deploying LG7, we thought founders should raise at least 18 months of revenue free runway at Seed. Today, the median time from reported Seed to Series A is 18 months, but considering the common lag in reporting for Seed rounds — 18 months should be the bare minimum.

- How much money should I raise? $2–3m possibly with a pre-seed — We always believed that writing slightly larger cheques at seed made a material difference to founders’ chances of graduating to Series A. We now know that companies raising $2–3m in total Pre-Series A funding convert better than those raising less, but raising more than $3m does not improve conversion rates.

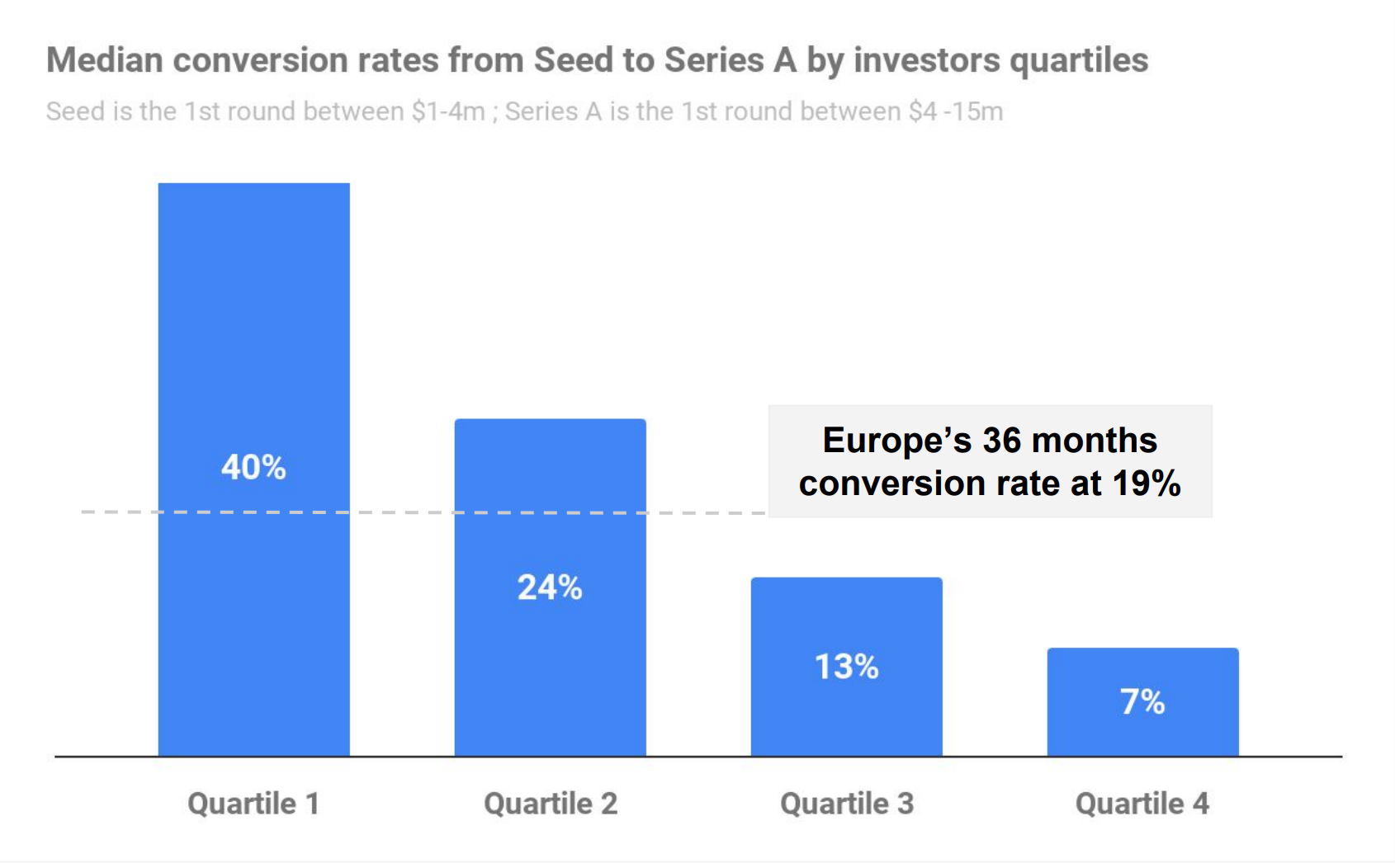

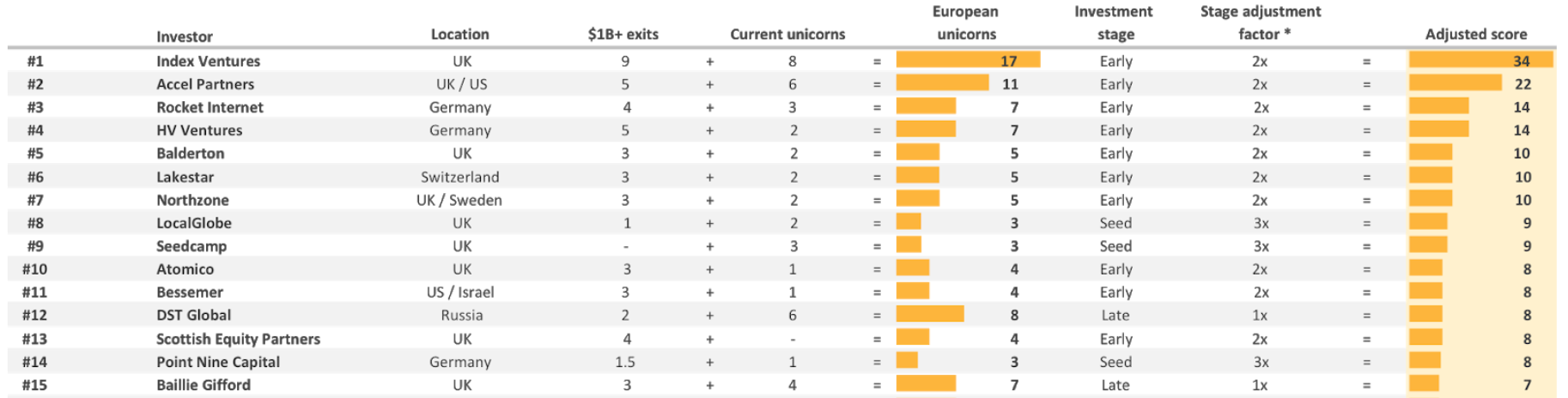

- Who should I raise from? Raise from top quartile funds if you can. You’re more likely to get to Series A & get there faster — We believed we had best-in-market graduation rates from Seed to Series A in Europe. The data says we do. We’re top decile along with our frequent co-investors Point9 in Berlin & Passion Capital also in London. The data also shows that companies raising Seed from top investors raise Series A faster. We believe the same holds true at Series A and beyond — watch this space.

We also observed that what we all called “Series A” was changing. The data now shows a clear split between $4–7m for “Old” Series A, and $7–15m for “New” Series A. You can read the Dealroom report in full here & expect more from Michael Mashkautsan on Series A over the coming months.

And Seed funds are coming of age… there are three Seed funds in Europe’s top 15 unicorn hunters

And us… LocalGlobe has always been totally dedicated to Seed

- We’ve been fortunate to have been Seed investors in $billion companies like Zoopla, TransferWise, and Improbable. Seeing the Seed to Series A and beyond for these outstanding companies in London.

- Since May 2015 we’ve invested over $70m in 50 companies. Over 80% of our capital has been invested in UK based companies.

- Our portfolio companies alone have raised over $3 billion in follow-on capital, since May 2015. And yes, that $502m Improbable round helped 🙂

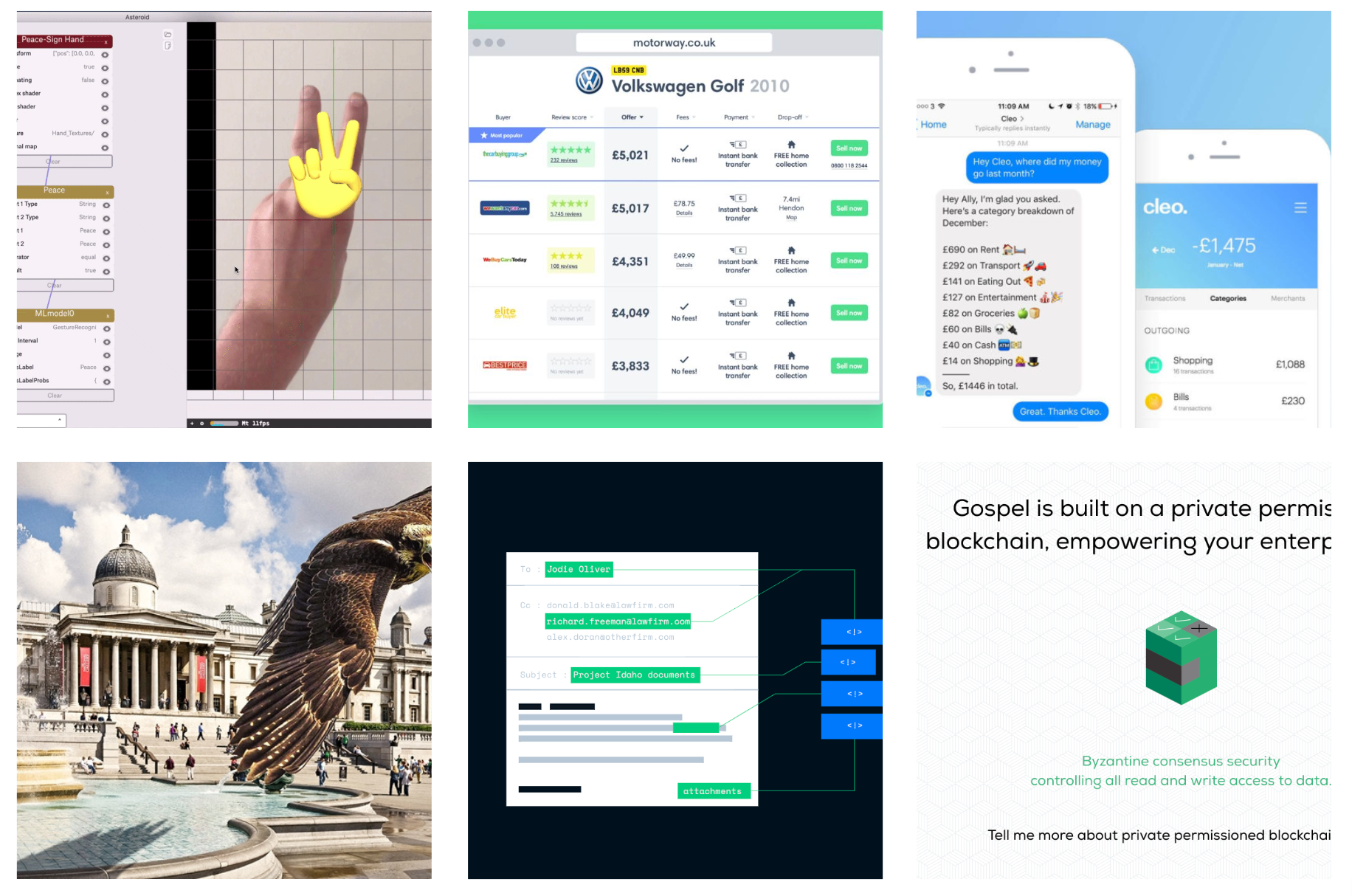

- Over the last 12 months, LG7 (2015) & LG8 (2017) portfolio companies have raised $300m in follow-on capital from top investors in Europe, the US, and Asia. e.g. over the last month Cleo $10m, Hometree $8.5m, Travelperk $38m.

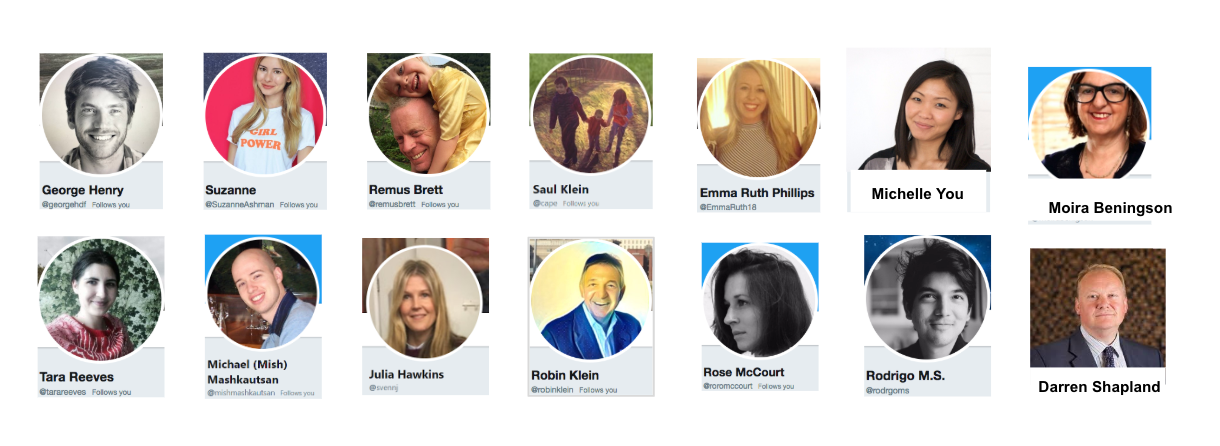

- We are now an integrated investment and operations team of 11.Over the last year, our open hiring process delivered three new investment partners — Remus, Mish and Julia. The core team is working alongside top operations hires — Rodrigo on data science (Oxford PhD and Visiting Researcher at The Alan Turing Institute); Michelle, co-founder of Songkick on product; Darren on finance (ex CFO Sainsburys); and, Moira on talent (MBS). We are lucky to be supported by a great additional group of seven additional LocalGlobe fellows and friends.

- Specialist & relevant support for founders at the earliest stage — We offer active and collaborative support but in a highly structured way — fundraising support, impactful introductions to customers and suppliers, personal and professional development, events and workshops.

- And soon we’ll have a dedicated space — We’re looking forward to our new home at Phoenix Court in Kings Cross. It’s at the centre of one of the greatest knowledge clusters anywhere in the world. Within a few hundred metres you can find the world’s earliest books at the British Library and the best creatives at Central St Martins, there’s emerging young talent from UCL, the best AI companies in the world at DeepMind, and cutting-edge biomedical research at the Francis Crick Institute. Our new building is less than two minutes’ walk from both St Pancras International and King’s Cross train stations. It means we’re two hours away from Manchester (home to 5 unicorns) and an hour from Cambridge, which combined with Oxford, is home to nine unicorns. We’re so close to Paris that we’re almost the 21st arrondissement.

We work together as a team, with founders and with other investors

- We play total football — we have fully integrated our investment and operations team, discarding conventional notions of investment attribution, letting the full team contribute to investment decisions and company support. Inspired by a country just a few hours away on the Eurostar, we’ve posted in the past about playing total football at LocalGlobe. The famous Holland 1974 team had a formation of 10, with anybody capable of playing anywhere.

- We look for fund returners — with thanks to our long standing LP Horsley Bridge and A16Z’s Chris Dixon — we are well aware of the Babe Ruth effect. “Building a portfolio that can deliver superior performance requires that you evaluate each investment using expected value analysis. We call it the Babe Ruth effect: even though Ruth struck out a lot, he was one of baseball’s greatest hitters”. Good funds have more home run investments; that is portfolio companies returning at least 10x. For great funds, the home runs are 20x. For the best funds, the home runs are almost 70x. But these great funds strike out a lot — they lose money more often than good funds do. You can’t knock it out of the park without strikeouts.

- We are long the UK opportunity — The UK has created 60 unicorns(38% of total European unicorns) and the lead has been increasing over the last 5 years.The future looks promising too. The UK has more futurecorns valued between $250 million and $1 billion than any other European nation — companies like Citymapper and Secret Escapes.

- We continue to stay close to other core geographies — we’ve invested in Paris, Berlin, Stockholm, Barcelona, Madrid, Zagreb, Nairobi, and Tel Aviv — and of course NYC and SF. This allows us to maintain close relationships with trusted co-investors across these cities.

- We are sector agnostic and come with a prepared mind — Inspired by Accel, we share a thesis-based approach of having a “Prepared Mind.” We’re comfortable investing across multiple sectors including Creative Industries; Education; Energy; Fashion; Finance; Food; Health; Insurance; Property; Security; Travel & Transport

We’ve continued to maintain a global perspective by selectively investing with founders and known investors in key markets — Paris, Berlin, Tel Aviv, Nairobi & Stockholm.

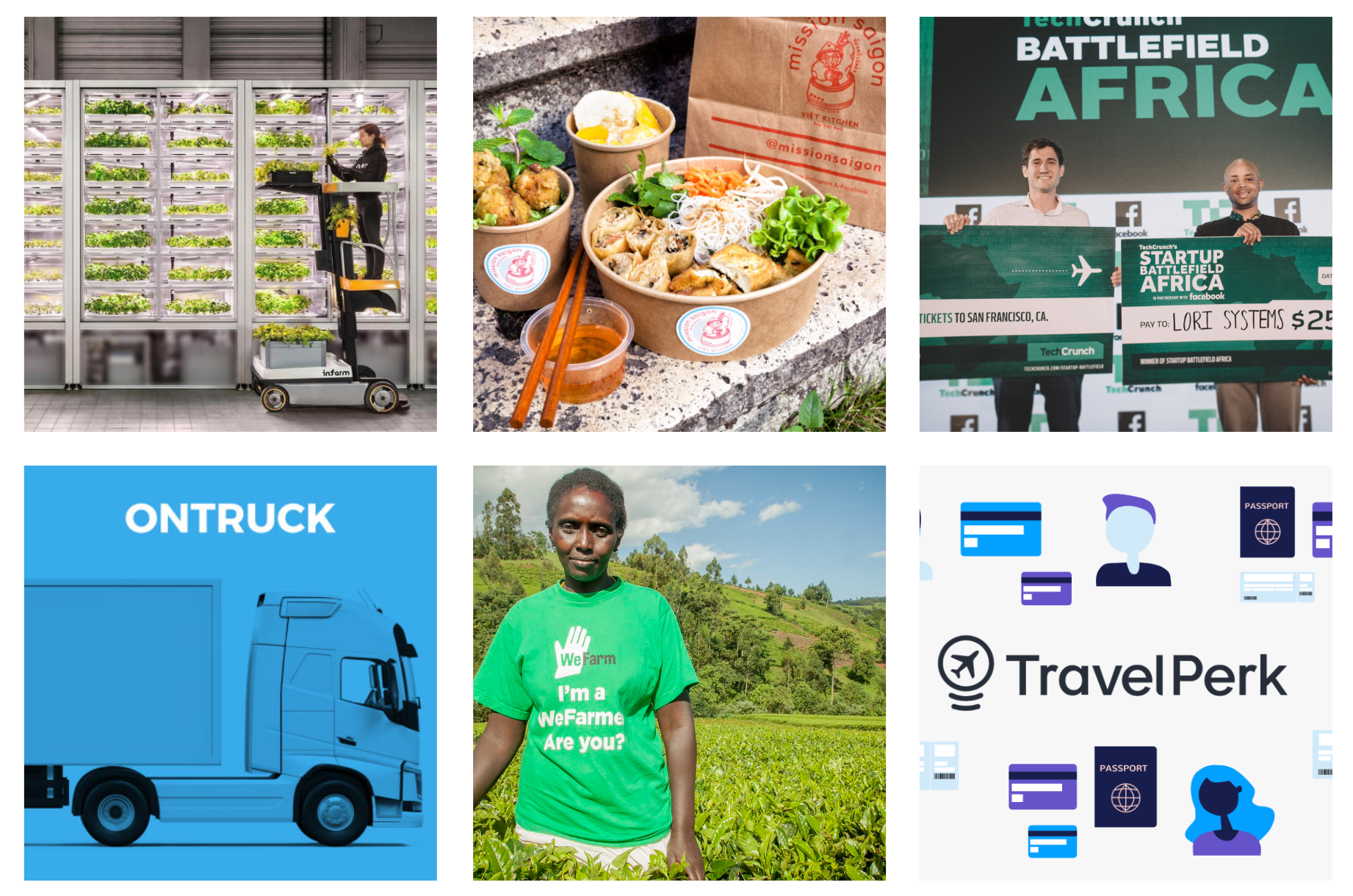

- We backed Taster in Paris, where ex-Deliveroo exec Anton Soulier is building restaurants for online platforms; and we’ve continued to support InFarm in Berlin, a startup that has developed indoor vertical farms for supermarkets, restaurants and local distribution centres, bringing fresh food much closer to the consumer.

- We’re delighted with the progress of Barcelona’s TravelPerk and Madrid’s OnTruck.

- We’ve made another Kenya-based investment this year — Lori, a logistics platform to improve cargo transportation across Africa. We’ve also continued to support WeFarm, a Nairobi-based peer-to-peer knowledge sharing network for farmers. WeFarm recently hit a million farmers and secured a $5m seed round led by True Ventures.

- This year we’ve invested with Aleph, Bessemer and Lightspeed — alongside a collection of great angels in Israel.

We are long on Seed and welcome the era of real ecosystem data