ESG Channel, SPECIAL TO ETF TRENDS

By Mona Naqvi, Senior Director, Head of ESG Product Strategy, North America, S&P Dow Jones Indices

Whoever said size doesn’t matter, wasn’t talking about ESG. For years, we’ve known that larger companies tend to fare better when it comes to sustainability.[1] But thanks to the launch of the S&P MidCap 400® ESG Index and S&P SmallCap 600® ESG Index, that may be about to change.

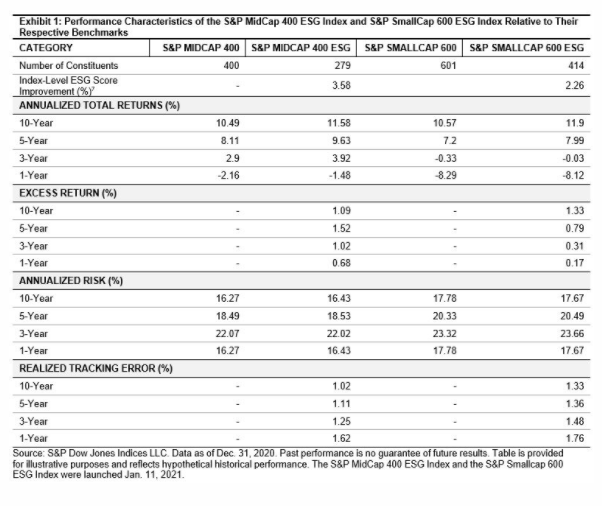

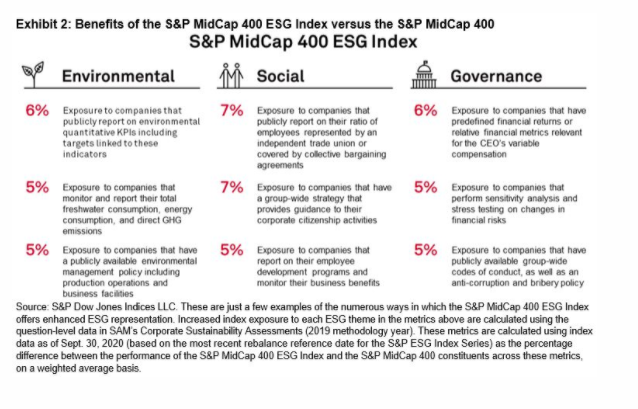

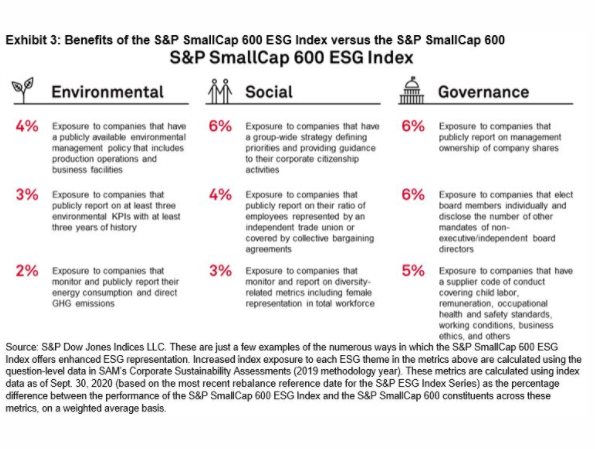

As per the S&P ESG Index Series Methodology, the indices aim to offer benchmark-like returns and improved sustainability profiles relative to their benchmarks (see Exhibits 1-3). Above all, however, they represent a new sustainable frontier in a space left largely untouched by ESG indexing to date. Indeed, scant reporting of sustainability metrics among smaller-sized firms has thus far dampened ESG efforts below a certain cap size. But thanks to the rules-based selection process and direct company engagement of our annual Corporate Sustainability Assessment (CSA), the methodology is uniquely positioned to:

- Educate smaller firms on sustainability topics of growing importance to investors;[2] and

- Raise the bar on sustainable business practices as companies compete to join the ranks of the ESG indices.

Perhaps the biggest contribution these indices may make, then, is to influence greater reporting and sustainability standards among medium and small-sized firms—beyond just the typical titans of the S&P 500®.

However, the fact remains that there is relatively less disclosure of ESG topics among smaller firms at present,[3] and that larger companies tend to perform better on these issues (i.e., size really does matter).[4] This positive correlation between ESG performance and firm size means that the standard ESG score exclusion criteria would likely result in an eligible universe that is simply too narrow to maintain a broad and diversified index.[5] To remedy this, we apply minor adjustments to the methodology for the 400 and 600 versions to ensure the indices can satisfy the S&P ESG Index Series objective. For instance, screening out companies at lower ESG score thresholds where necessary and at the local index level, rather than among global industry group peers.[6]

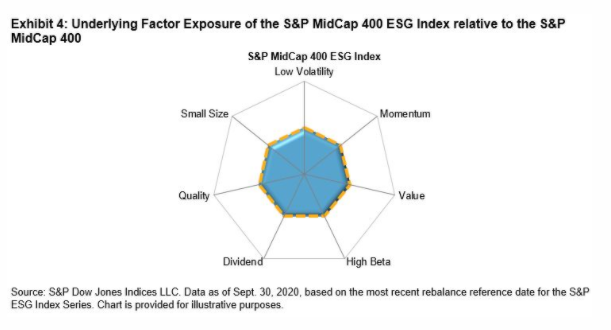

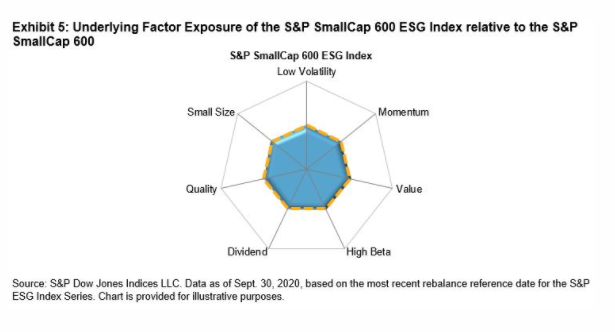

With these adjustments, the resulting 274 constituents of the S&P MidCap 400 ESG Index and 407 constituents of the S&P SmallCap 600 ESG Index manage to closely replicate the underlying risk/return profile of the respective benchmark (with welcome outperformance; see Exhibit 1)—as well as provide measurable ESG improvements (see Exhibits 2 and 3). This result, coupled with an almost identical underlying factor exposure to their benchmarks (even when it comes to size, surprisingly) confirms that these new ESG indices are poised to do precisely what they are intended to do (see Exhibits 4 and 5). Thus, as these indices assume their rightful place alongside the flagship S&P 500 ESG Index, we can finally say that sustainable investing is no longer just a large-cap solution—it is now an all-cap solution.

For more on the S&P MidCap 400 ESG Index and S&P SmallCap 600 ESG Index, read the addendum to our white paper, “The S&P 500 ESG Index: Defining the Sustainable Core.”

Originally published by Indexology, 2/17/21

1 A positive correlation between sustainability performance and firm size is generally observed due to the greater visibility, access to resources, and operating scale associated with large firms. See, for example, Drempetic, S., Klein, C., and Zwergel, B. “The Influence of Firm Size on the ESG Score: Corporate Sustainability Ratings Under Review.” Journal of Business Ethics (2019) for more information.

2 See Naqvi, M. and Jus, M. “The Benchmark that Changed the World: Celebrating 20 Years of the Dow Jones Sustainability Indices”, S&P Global (2019) for more information.

3 According to this WSJ article (2019), “Midsize and small companies generally lag behind their larger peers in terms of disclosure because they are less likely to have resources such as ESG-dedicated team or a sustainability department”.

4 See footnote 1.

5 As per the standard S&P ESG Index Series Methodology, companies with an S&P DJI ESG score that falls within the worst 25% of ESG scores from each GICS Global Industry Group are excluded from the indices (alongside other exclusions (tobacco, controversial weapons, thermal coal, companies that perform poorly on the UNGC principles, and companies involved in material controversies), before then targeting 75% of the remaining, eligible universe of companies ranked by S&P DJI ESG score within their respective index industry group.

6 See page 8 of the S&P ESG Index Series Methodology for more details on the adjustments made to the exclusion criteria for the S&P MidCap 400 ESG Index and S&P SmallCap 600 ESG Index.

7 The relatively low index-level ESG score improvement is a consequence of the generally low ESG scores among small- and mid-sized companies, as discussed. Please refer to Exhibits 2 and 3 to better understand the sustainability enhancements associated with the S&P MidCap 400 ESG Index and S&P SmallCap 600 ESG Index across the individual E, S, and G dimensions.

The posts on this blog are opinions, not advice. Please read our Disclaimers.