Nasdaq, CONTRIBUTOR, PUBLISHED

While 2020 has been a year for most to forget, it’s been one to remember for environmental, social and governance (ESG) investing. The ESG space was highlighted by sustainable fund assets reaching the $1.2 trillion mark in the third quarter.

“Assets in sustainable mutual funds and exchange-traded funds globally hit a record $1.2 trillion in the third quarter, up 19% from the second quarter, according to Morningstar. In the U.S., assets in sustainable funds jumped to $179 billion, up 12.5% from $159 billion at the end of June,” a Barron’s article noted. “Net inflows globally jumped 14% in the third quarter to nearly $81 billion, Morningstar said. The U.S. accounted for 12% of the flows, and Europe 77%.”

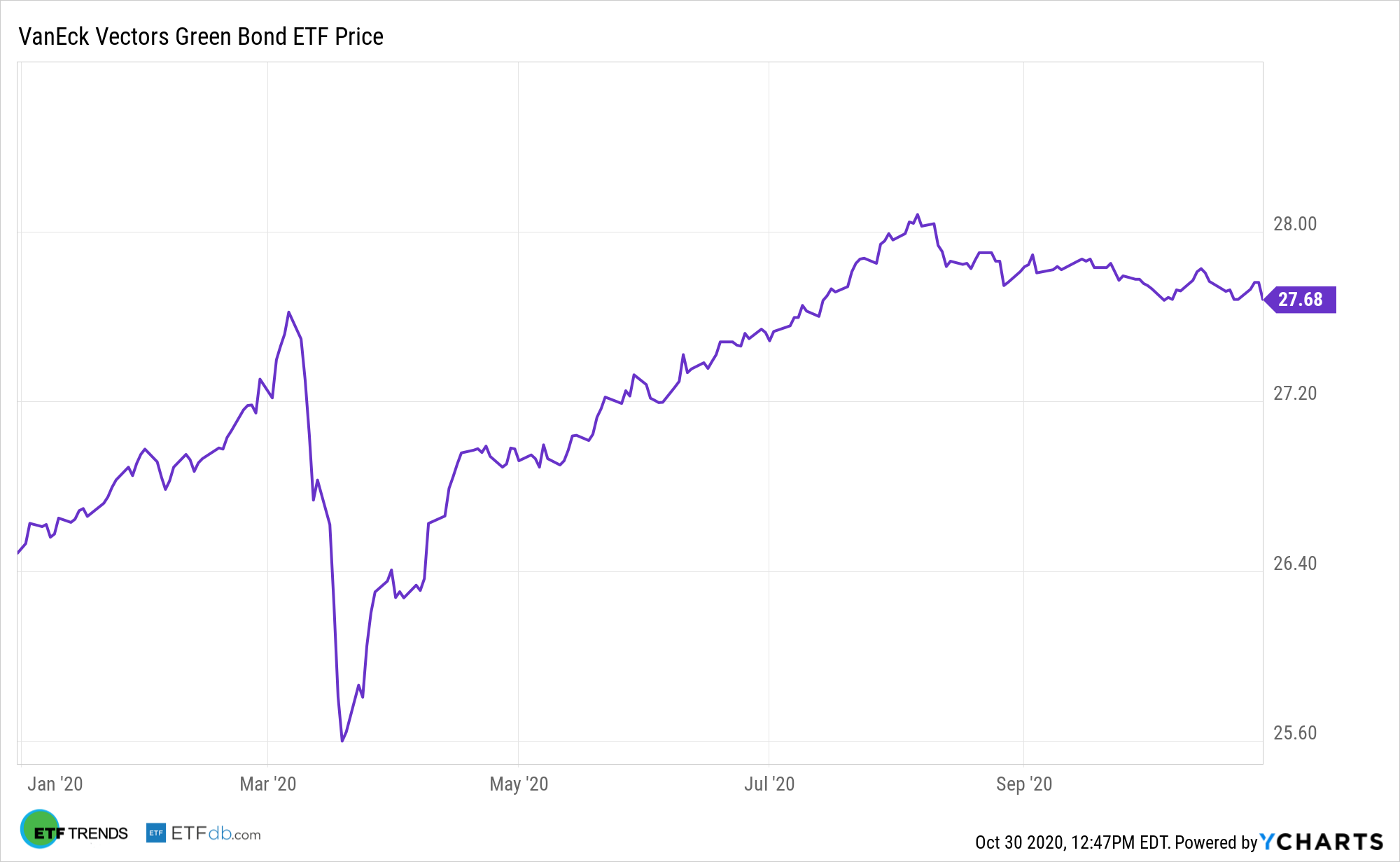

ETF investors can get this green exposure via equities, but also bonds. The bond market was strong during the height of the pandemic and with help from the Federal Reserve, but for investors who want the best of both bond and ESG worlds, there’s the VanEck Vectors Green Bond ETF (GRNB).

GRNB seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the S&P Green Bond U.S. Dollar Select Index (the “index”). The fund normally invests at least 80% of its total assets in securities that comprise the fund’s benchmark index. The index is comprised of bonds issued for qualified “green” purposes and seeks to measure the performance of U.S. dollar denominated “green”-labeled bonds issued globally.

GRNB gives investors:

- Access bonds issued to finance projects that have a positive impact on the environment

- An ESG solution for a core bond portfolio

- Index includes only U.S. dollar-denominated bonds designated as “green” by the Climate Bonds Initiative

Shifting towards equities, other funds to look at include the FlexShares STOXX US ESG Impact Index Fund (CBOE: ESG). Investors who want ESG exposure and global diversification can look to the FlexShares STOXX Global ESG Impact Index Fund (CBOE: ESGG).

For more news and information, visit the Tactical Allocation Channel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.